About Time: Biden-Harris Wants Companies to Stop Putting You Through Unnecessary Hassles

How the Burden Reduction Agenda is Evolving

Over the last few years, the Biden administration has built a policy infrastructure to identify and reduce administrative burdens in public services and benefits. An animating theme is that government should, where possible, cut the “time tax” that citizens experience in everyday life.

In a recent and notable shift, the Biden-Harris administration is signaling that they also want to tackle private sector burdens. This marks a major milestone in the federal government’s attention to the issue, and a marriage between two signature aspects of how Biden has used executive authority: to protect consumers on the one hand, and reducing unnecessary administrative burdens on the other.

In this post, we will focus on what is being done to regulate private sector sludge.

Cutting the Time Tax Imposed by Private Organizations

On August 12th, the Biden administration (ahem, the Biden-Harris administration) released a statement announcing a “New Effort to Crack Down on Everyday Headaches and Hassles That Waste Americans’ Time and Money.”

A couple of points are notable here.

The Overdue Politics of Burden Reduction

Biden-Harris are seeking a political payoff from burden reduction, framing this language as a benefit for regular Americans, who “are tired of being played for suckers, and President Biden and Vice President Harris are committed to addressing the pain points they face in their everyday lives.” They label the effort as “Time is Money.”

This is what it sounds like when communications staff look at existing initiatives on the eve of an election, and tries to explain to the public, in plain terms, what they have been up to. For Harris, it offers a tangible Biden-era regulatory agenda she can extend as President. She has already embedded consumer protection themes in her campaign, such as opposing price gouging.

This is good. Burden reduction, if done right, should benefit the public. It should use the power of the government to step in and protect us in ways that we, as individuals, are powerless to do so. And such efforts are more likely to stick if government can offer a compelling message about what it is doing.

When we wrote our book “Administrative Burden” we noted the paradox between the fact that everyone has a story (or many) about how maddening administrative processes could be, but this frustration was largely ignored by political actors. Giving hassles more political attention, or at least a fraction of the political attention that we see for sludge imposed on private companies is overdue. (Parenthetically, we are interested in how much media interest this agenda generates, since media companies engage in some of the most nefarious practices the Biden administration is targeting, such as making it very easy to sign up for subscriptions, but very difficult to cancel).

Asserting A Regulatory Role in Reducing Hassles

The government is asserting a larger regulatory role in fixing privately-created burdens in a more explicit and pronounced way than we have seen in the past.

The justification is that private organizations engage in deceptive practices and generate negative externalities in how they abuse the time of their customers. Moreover, private markets are not resolving this problem: the incentives to do things like make it nearly impossible to cancel a subscription are strong. The White House fact sheet put it like this:

These hassles don’t just happen by accident. Companies often deliberately design their business processes to be time-consuming or otherwise burdensome for consumers, in order to deter them from getting a rebate or refund they are due or canceling a subscription or membership they no longer want—all with the goal of maximizing profits.

A classical economic explanation might be that people don’t actually value good customer service, or their time, and so tolerate frictions. A behavioral science perspective suggests that such frictions are opaque, and private actors are deliberately using hassles to force people to make economic choices they don’t actually want to make, often in the form of hidden costs, or difficulty in exiting from economic commitments that were promised to be non-binding. On that basis, government intervention is justified.

Reducing the Burdens in Health Care

The federal government has an especially strong claim on addressing burdens in health care, in part because of it’s vast role in subsidizing its costs. It does so directly, by paying health care providers and suppliers via Medicare and Medicaid, and increasingly indirectly, by subsidizing health insurers via Medicare Advantage, Medicaid Managed Care, and Obamacare private exchange plans. Indeed, over half of Medicare beneficiaries are now enrolled in a private Medicare Advantage plan.

Another good reason for the federal government to regulate health care hassles is that Americans face extraordinary administrative burdens, thanks in no small part to the fragmented and marketized system of service delivery and insurance, where burdens are used to control costs and enhance profits. Our book, for example, lays out the intense burdens Medicare beneficiaries now face given the growth of private insurers in that program.

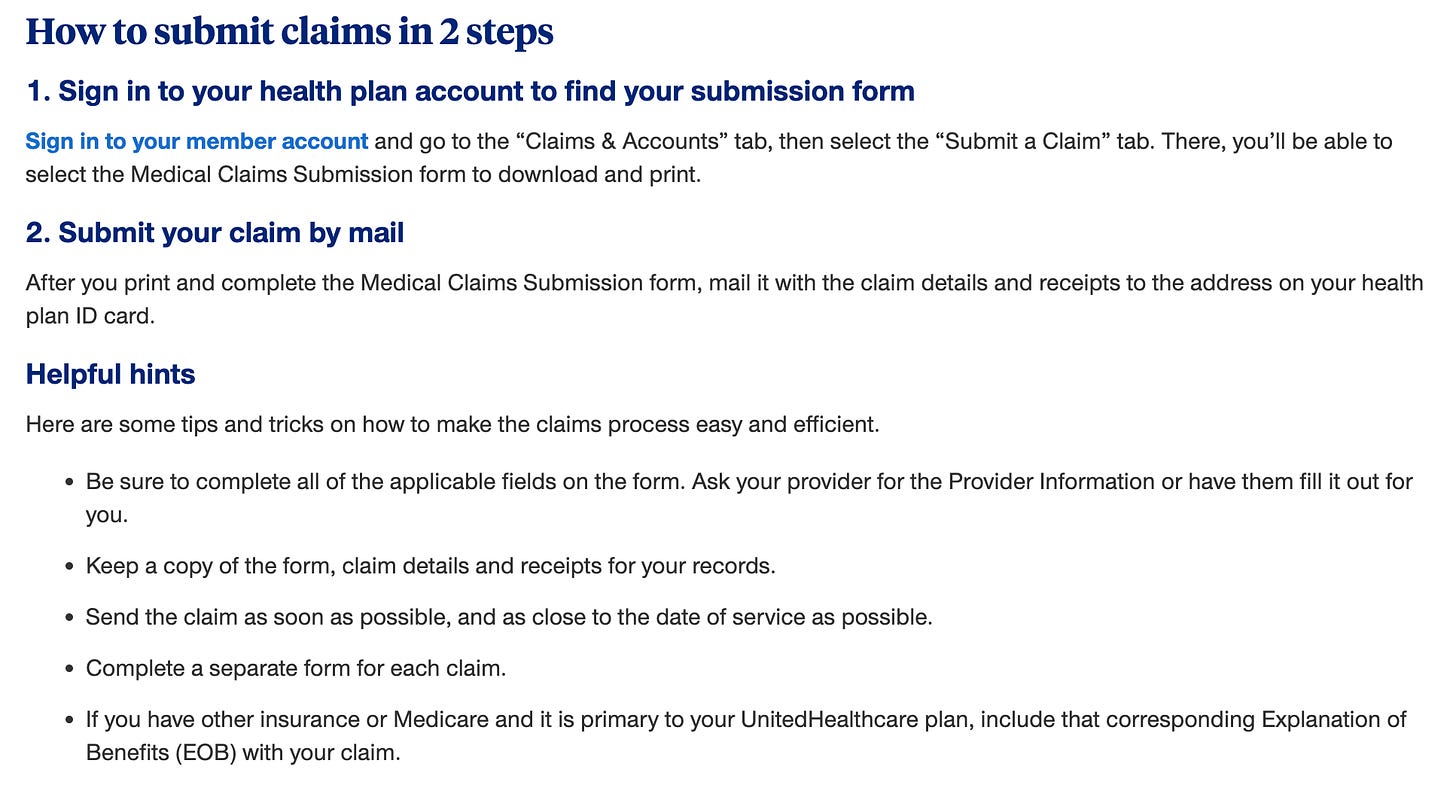

While a small step, Biden-Harris are signaling they want to address these burdens. In their recent initiative, they push health insurance companies to allow people to submit their health insurance claims online. No more requirements to send claims to a fax machine number, mail, or a phone doom-loop that takes hours to complete. It’s a simple proposal, but may be surprisingly impactful. By one estimate, we lose over 100 billion dollars a year for simply the amount of time we spend on the phone with health insurance companies. Filing claims with United Health Care, which has a 15 percent market share, requires people to take these steps to file a claim:

Requiring forms to be mailed adds frictions to an already difficult process. It adds a time delay. It also increases the amount of time people need to spend on the process. While there isn’t data on how large of an impact this has on claim submission, it’s worth pointing out that firms trying to sell you something would not require you to fill out a paper form and mail it. Given the federal government involvement in this sector, it seems reasonable that they ask private insurers to join the 21st century when it comes to managing claims.

Biden-Harris also sent a letter to health care CEOs bemoaning the “frustrating, confusing, and time-consuming experiences with health coverage” while pointing to data that such burdens restrict access to care. The letter emphasized not just the need to move to online health care claims, but pushed CEOs to adopt other practices:

Helping individuals enroll in the right plan by streamlining processes and providing clear, digestible information about health coverage.

Providing individuals with critical information in clear, accessible language that limits jargon.

Denying claims only when appropriate, including ensuring that patient care decision support tools (including but not limited to algorithms) and other internal protocols are not misused to deny coverage of necessary care. When an individual’s claim is denied, providing simple, step-by-step instructions on appeals and ensuring the appeals process is minimally burdensome.

Improving customer service support so that individuals can have questions answered swiftly. If people want to talk to a customer service agent, they should be able to do so quickly, conveniently, and without long wait times. If individuals prefer to interact electronically – such as by text, email, or online portal – there should be simple and easily identified ways that comply with appropriate federal civil rights and privacy laws.

Identifying ways to make finding critical information about in-network clinicians and facilities, as well as prescription drug formularies, easier with accurate and user-friendly tools on accessible websites and customer portals.

Providing information about prior authorization and other medical management rules in clear, accessible language and streamlining these processes where possible.

Providing critical information in a culturally and linguistically appropriate manner that considers the specific needs of the demographic of individuals in your service area, including people with limited English proficiency and people with disabilities.

Ensuring compliance with applicable provisions of the Affordable Care Act (ACA) and No Surprises Act (NSA) that are designed to increase transparency and streamline appeals processes, such as the NSA’s price comparison tool and provider directory accuracy provisions, as well as the ACA’s internal claims and appeals process provisions.

Removing individuals from the middle of surprise billing disputes by following NSA provisions, including appropriately identifying when an out-of-network claim is subject to the NSA and complying with the deadlines for disclosures and payment.

All of this is a lot to process, but the bottom line is that it shows a federal government signaling to the private industry, which perhaps generates the most administrative costs on the public, that those burdens will be more closely monitored in the future, and that there is an expectation that burden reduction tools will be deployed. This is especially important given growing use of private health insurers in both the Medicare and Medicaid programs. Here, in particular, the federal government has real leverage to push insurers to change their practices.

Principles for Policing Private Sector Burdens

Allowing you to submit health claims online is one of seven areas where Biden-Harris offer proposals to fix private sector practices that increase the time tax. Here are the other six:

Making it easier to cancel subscriptions and memberships.

Ending airline runarounds by requiring automatic cash refunds.

Cracking down on customer service “doom loops.”

Ensuring accountability for companies that provide bad service.

Taking on the limitations and shortcomings of customer service chatbots.

Helping streamline parent communication with schools.

Some of these are existing initiatives (getting cash refunds from airlines), some are new, but this is the first time they have been collected and branded as a single policy agenda. They are also feasible using executive authority, via agencies such as the FCC and the CFPB, which makes sense given that any legislative options for addressing regulatory issues fell off the table once Republicans tool control of the House.

The examples are illuminating, but what about the underlying principles? Rather than paraphrase them, we will simply share them verbatim, because we think they are compelling enough to guide government regulators.

Companies should make it as easy to do things that you want to do as it is to do things they want to do.

It should be as easy cancel a subscription or membership as it is to enroll.

It should be as easy to obtain rebates and refunds as it was to purchase, with no needlessly cumbersome paperwork.

Refunds and rebates should be paid as quickly as companies take funds from your credit card or bank account.

Americans should be able receive customer service on their terms and their own time without significant hassle or hardship.

If you want to talk to a human, you should be able to talk to a human at convenient times and without interminable waits.

If you prefer to interact electronically – such as by text, email, or online portal – there should be simple and easily identified ways to do so securely.

Technology – such as chatbots – should be used to enhance customer service with speedy response times, not used to shirk on basic responsibilities, such as receiving a refund.

Americans should not be subject to confusing, manipulative, or deceptive practices online.

If you want to understand what you must do to obtain a good or service, the requirements should be clear and transparent.

You should not be subject to hidden fees or to requirements that are obscured through confusing language and small print.

Of course, those suspicious of government regulation might note the irony of trying to curb administrative hassles through more regulation. Maybe regulators will go too far. But even the most hard-bitten libertarian would struggle to claim that the private market is addressing the abuse of customer’s time. The risk of over-regulation seems distant compared to the costs of under-regulation at this point. The onus should be on private organizations to make the case that the benefits of wasting their clients time are so vital to the economy that they should be protected.

An obvious rebuttal to the emphasis on burdens created by private organizations is that government does plenty to create hassles. What, exactly, is it willing to do about those? And a good response is that the Biden administration has been toiling away on this topic. We will say more about that in a follow-up post!

I've been so happy to see these efforts to reduce administrative burdens within government but also within the private sector. This essay gives a great summary of the problems and some of the solutions, and proposed solutions. I'd also love to see members of Congress actually try to deal with these problems as customers. Maybe set them up in a room with a laptop and a cell phone and let them try to figure out how to get a refund or a rebate, or cancel a subscription, or get an airline to refund a cancelled flight. Many people in Congress don't deal with ordinary, everyday problems (staff, spouses and others do this for them) and this would be a good exercise for them. I'd also like to see better information for people who will be deciding on whether to sign up for Medicare or for a Medicare Advantage Program. If you watch cable TV during sign-up periods you're inundated with Medicare Advantage ads which are trying to sell you a service and which don't provide basic information on how the insurance company makes its money. There's a lot of YouTube videos but it's difficult to figure out who's behind the videos. Medicare should have its own channel (if it doesn't already) where people can get more objective information. The IRS does this and provides these videos in different languages.