Recently, on Bluesky, Mark Cuban posed a question.

As an aside, this is a good side of the maturation of Bluesky. A well known figure asks a sincere question, hoping for a reasonable response from some smart people. This is what Twitter used to be great at before Musk.

Here is my response to Cuban’s question. It includes some really basic facts about the nature of make-up of the federal workforce and spending. Once you take these facts into account, it suggests a) the size of the cuts promised will not materialize, and b) savings will not be redistributed to reduce poverty, but will do the opposite.

You can’t eliminate the deficit by cutting federal employees

Muskawamy are promising huge savings. Musk says that he can cut spending by $2 trillion every year. Ramaswamy has proposed to cut 75% of employees. These are pie-in-the-sky numbers, but lets assume a genuine appetite for large cuts.

It is possible to cut a lot of federal employees and dramatically cut the spending of the federal government. But it is not possible to dramatically cut the spending of the federal government just by cutting employees.

The federal government spends about $271 billion each year on personnel costs.1 Lets assume we go with Ramaswamy’s illegal and irresponsible proposal to cut 75% of employees. That saves you $200 billion per year. That would be about 10% of Musk’s proposed $2 trillion cuts, and a much smaller proportion of overall annual federal spending of $6.75 trillion.

Just to give another point of comparison, the 10 year costs of extending Trump’s 2017 tax cuts will be between $4 to $5 trillion over the next decade, with more than 40% of those tax cuts going to households earning more than $400,000 per year. In other words, the cost of Trump’s tax cuts are significantly higher than federal personnel costs. Just allowing the expiration of tax cuts on the highest earners generates similar savings as cutting 75% of federal employees. And, you still get to have a functional government! Or you can follow Ramaswamy’s goal of dramatically gutting the government, without meaningfully altering the deficit.

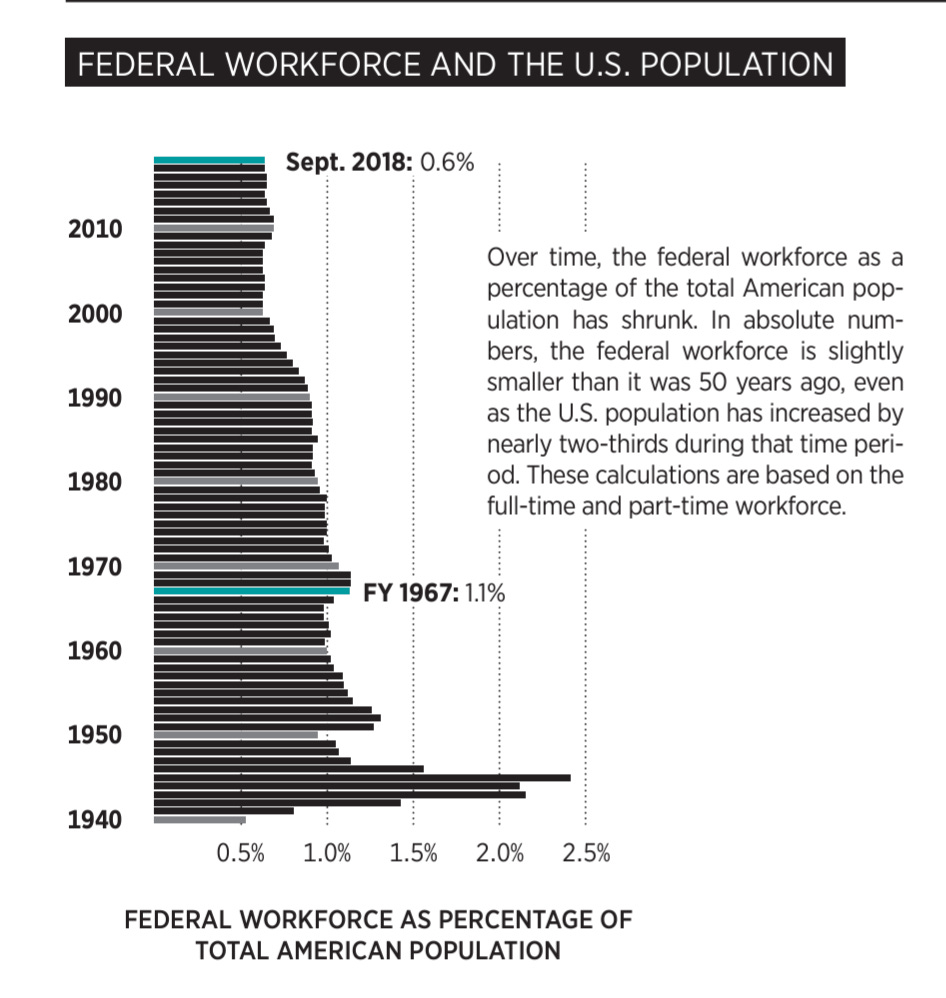

The federal government does not have too many bureaucrats

We have about the same number of federal employees than we had in the 1960s, even though the government does and spends a lot more now. As a percentage of the total population, the federal workforce is at historic lows:

If anything, we need more federal employees. We need younger employees, we need employees with more tech skills. We need employees who can better manage our contract workforce, who vastly outnumber the number of federal employees.

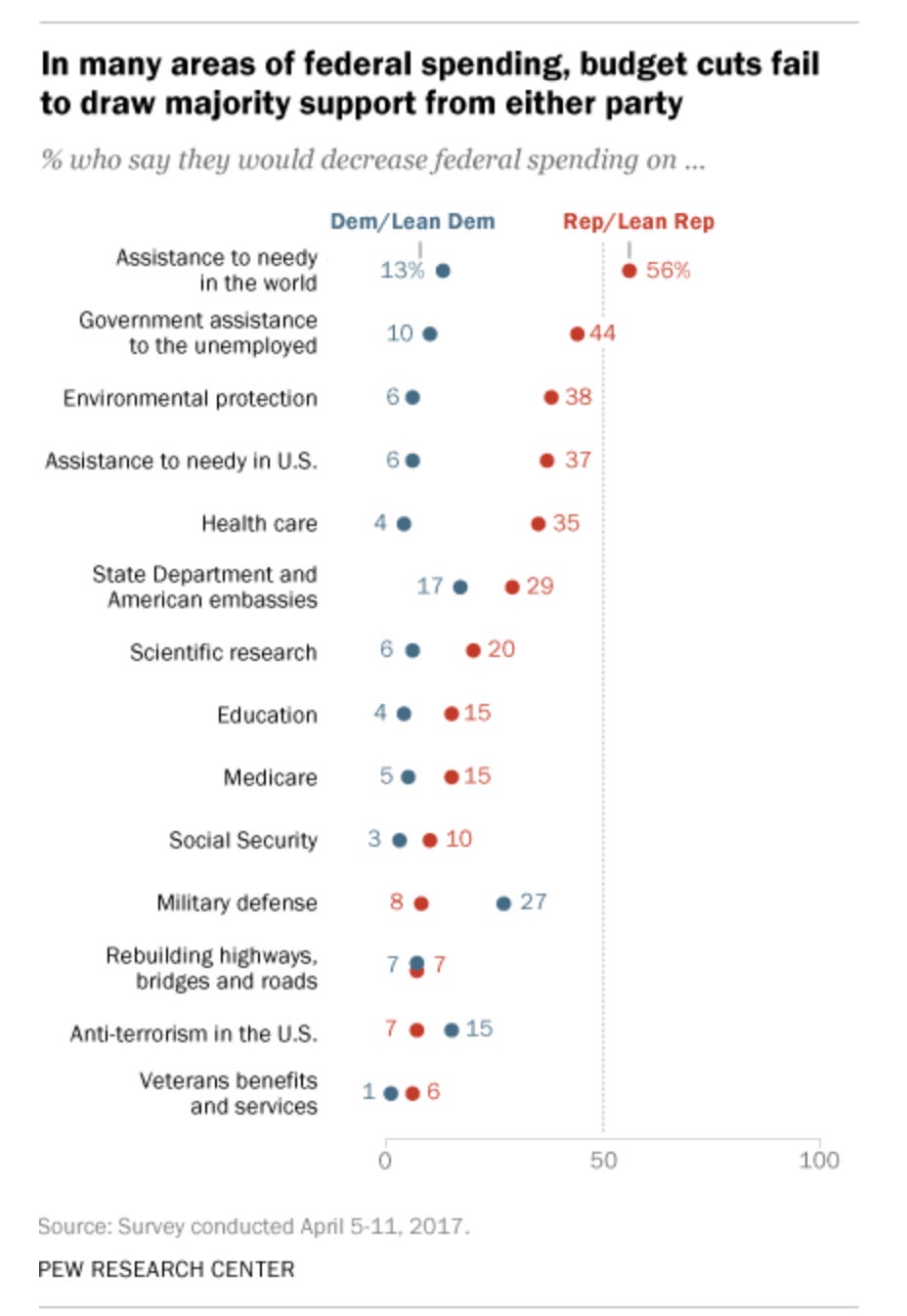

People like federal programs

People assume there are lots of employees working on irrelevant programs. But most programs exist and are staffed because people value them. In the abstract, people want to cut government, but their support for cutting specific programs is much lower.

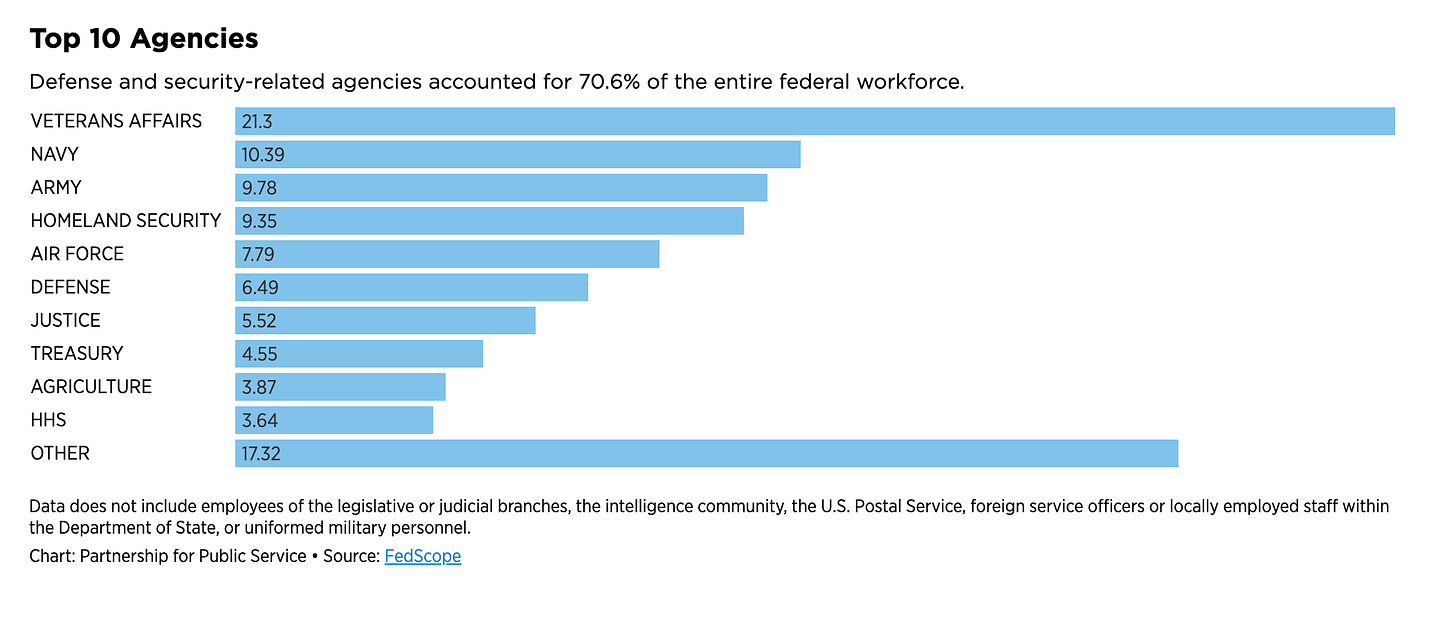

Most of our civilian workforce works in an area that has been relatively immune to cuts

As the graph above shows, spending on veterans, homeland security and military enjoys huge popular support. More than 71% of our *civilian, non-uniform personnel* work in these areas. In other words, popular support for federal programs and where federal employees actually work are closely aligned. And if you cannot cut these functions, there is simply not a lot of room for big cuts.

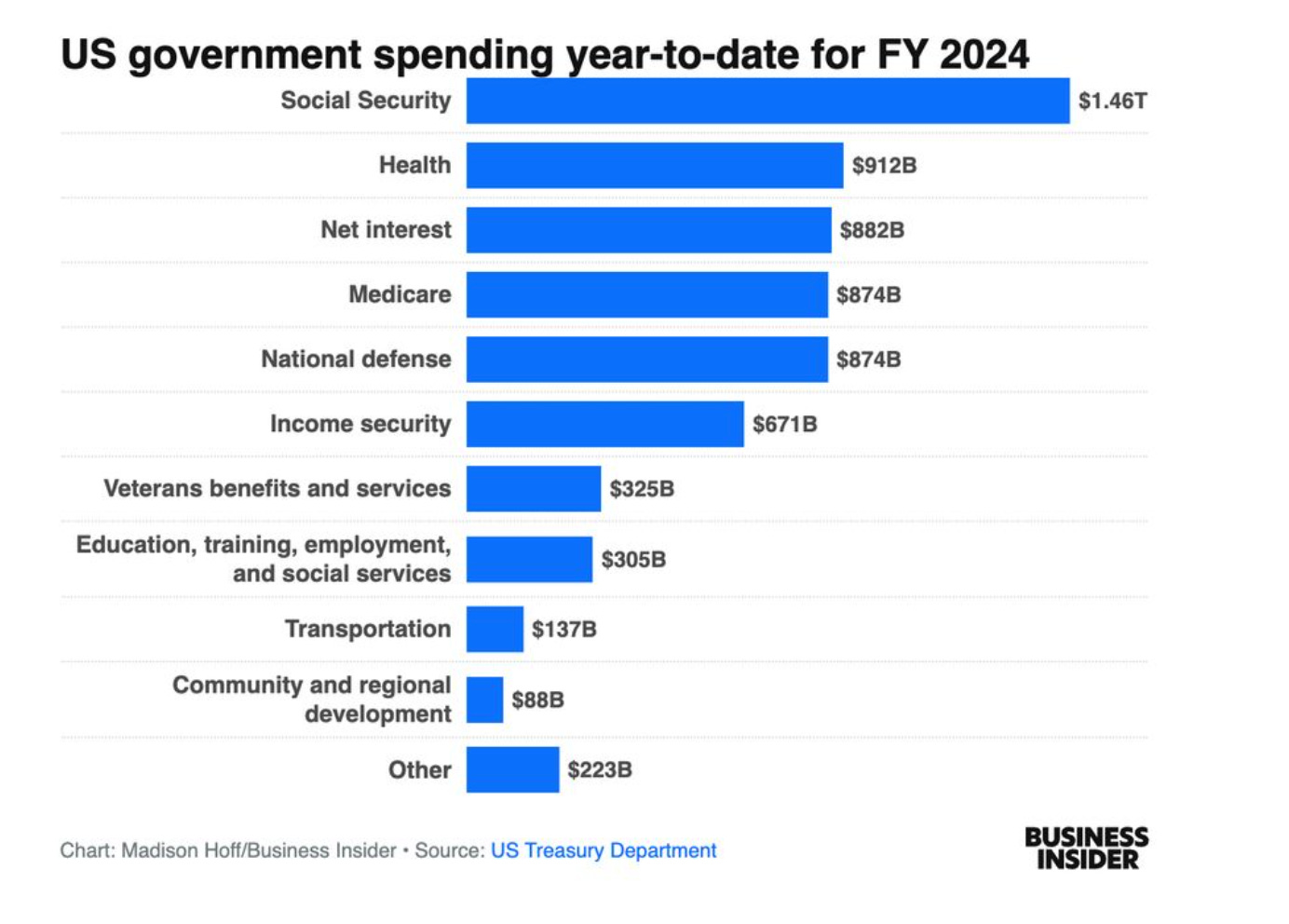

Most spending is on security or social programs

An oversimplification is that the American federal government is basically an insurance company with an army. So, which one do you cut? The premise of Cuban’s questions is that if we can cut fat, we can redistribute lots of resources to the less needy. But the US already does a lot of that, fairly efficiently in some places.

Social Security has administrative costs that are about 0.5% of expenditures. This is historically low (it was about 2% in the 1960s) and also was the primary objection to George W Bush’s proposal to privatize the program, which would have necessarily meant the program would have been more expensive to run. Similarly, more and more of our safety net is delivered not by expensive bureaucracies with high administrative costs, but via the tax code, with very low administrative costs.

There are inefficiencies in our enormously expensive health care systems, to be sure, and finding way to cut costs would be valuable. Most of the big-ticket savings in government spending that the Congressional Budget Office has identified (yes, smart people in government are already doing what Muskawamy promises to do) don’t involve cutting employees, but going after health care costs. Bear in mind that VA health provides better outcomes for less costs than our private health system, and it becomes clear that more creative solutions beyond privatization are needed. Besides, Trump has said he won’t cut Medicare or Social Security. Again, once you take the big ticket items from consideration, it is very hard to see where the big cuts that Musk proposed will come from.

Republicans have made redistributive program more bureaucratic

When Trump was in office previously, not only did he not try to reduce bureaucracy for eligible recipients of redistributive programs. He made those programs harder to access. For example, he ordered work reporting requirements for welfare benefits, which increased the administrative burdens on eligible applicants, many of whom lost benefits as a result, and required more bureaucracy to monitor the paperwork. So I am skeptical that any savings will be redistributed in a way that reduces poverty.

The UK experience of austerity was deeply destructive

Another group of right wing politicians came to government and announced a plan to cut costs. This was the UK Conservative Party. They succeeded. So what can we learn from them?

Their austerity project had enormous negative consequences. It gutted basic public services. It reduced life expectancy, and increased poverty and inequality. Far from making Britain great again, it quickened its decline. This piece by Sam Knight is sobering:

The U.K. has yet to recover from the financial crisis that began in 2008. According to one estimate, the average worker is now fourteen thousand pounds worse off per year than if earnings had continued to rise at pre-crisis rates—it is the worst period for wage growth since the Napoleonic Wars. “Nobody who’s alive and working in the British economy today has ever seen anything like this,” Torsten Bell, the chief executive of the Resolution Foundation, which published the analysis, told the BBC last year. “This is what failure looks like.”

The public eventually noticed that schools were falling apart, libraries were closing, and that police were not responding to calls. To achieve the type of savings that Muskawamy are promising would necessarily mean cutting services, including the safety net, on an even larger scale. The Trump administration could cause misery by, for example, cutting Medicaid and SNAP.

The Tories were wiped out in a wave election. Labour now presents itself as the face of responsible, sensible government. But to a large degree they are playing the hand that the Tories dealt them. With a weak economy and low tax revenues, they are not reversing austerity on any meaningful scale. Their policy that has perhaps drawn most attention is to cut winter fuel allowances. Simply being a more responsible stewards of state decline seems like a good way to bring the Tories back to power.

The idea that there is a lots of waste, fraud and abuse in government is mostly wishful thinking. It allows politicians, and the public, to say, and maybe even believe, they can have low taxes and lots of popular and expensive programs. Meanwhile highest ROI in government is to invest in tax collection. Will Muskawamy support IRS modernization, which is already paying off? Or will the Trump administration gut it? This is a pretty simple test of whether the administration is serious about fixing and modernizing government, or simply making government disappear, lowering their taxes and reducing regulation of their businesses. Unfortunately, their emphasis on cost cutting, rather than rebuilding state capacity, gives little reason for hope thus far.

This is according to CBO. OMB’s Analytical Perspectives documents lists higher numbers, but its not an order of magnitude different: $384 billion. Using these numbers, a 75% reduction would be over 14% of Musk’s promised cuts, or about 4% of total spending.

I doubt that Muskaswamy have ever read the Federal budget, or any of the details. Neither one has dealt with the departments and agencies they want to cut, except for the IRS. Even though your statement "Meanwhile highest ROI in government is to invest in tax collection." is absolutely true, I suspect the next Tax Law will extend and enlarge the 2017 tax cuts, and will decrease funding for the IRS and hurt it's collection efforts. Muskaswamy are arrogant, but they have no authority to affect the Federal budget. They'll have to go to Congress and they will want to control, not work with Republicans. I have no respect for almost all Congressional Republicans (and only situational respect for some of them) but I don't believe that any of them want to lose their leverage and to be told by Muskaswamy what to do. You'll then see all of them trying to be the last person to talk to Trump to push their own self-interest. I don't care what Republicans say, watch what they do, i.e., they didn't vote for Scott. There'll be an enormous amount of political sabotage, backstabbing and leaks to the press as the free-for-all begins, a political version of the Lord of the Flies. Trump is a lame duck and really, only wants to play golf, hold rallies and grift as his mental and physical health decline. He's also very susceptible to flattery and manipulation and this will go into hyperdrive. We have to resist the urge to treat Trump et al as "normal", efficient, logical and tied to a consistent ideological basis.

". Just allowing the expiration of tax cuts on the highest earners generates similar savings as cutting 75% of federal employees. And, you still get to have a functional government!"

Yeah, I don't think these folks care about having a functional government.