(In)Flexible Savings Accounts: The tax deduction that is actually a tax on your time

We register some complaints with the Washington Post

A bit more than 20 million Americans use Flexible Savings Accounts. We use and loath them at the same time, since it is one more administrative hassle we feel compelled to add to our lives.

What is surprising is how little information there is about FSAs, and whether they are actually benefiting anyone. We are more interested in visible programs, and less attentive to what Suzanne Mettler has labeled “the submerged state” via tax expenditures. FSA is a large program that is subject to precious little research, policy analysis or media coverage.

We wrote about this in the Washington Post. You can read a gifted version of the article here, and it is excerpted below.

It’s the end of the year, the season when families spend more time with loved ones … and with their flexible savings accounts. For example, the two of us just spent a good part of a day online and on the phone submitting claims for our daughter’s orthodontia bill and some mundane prescriptions.

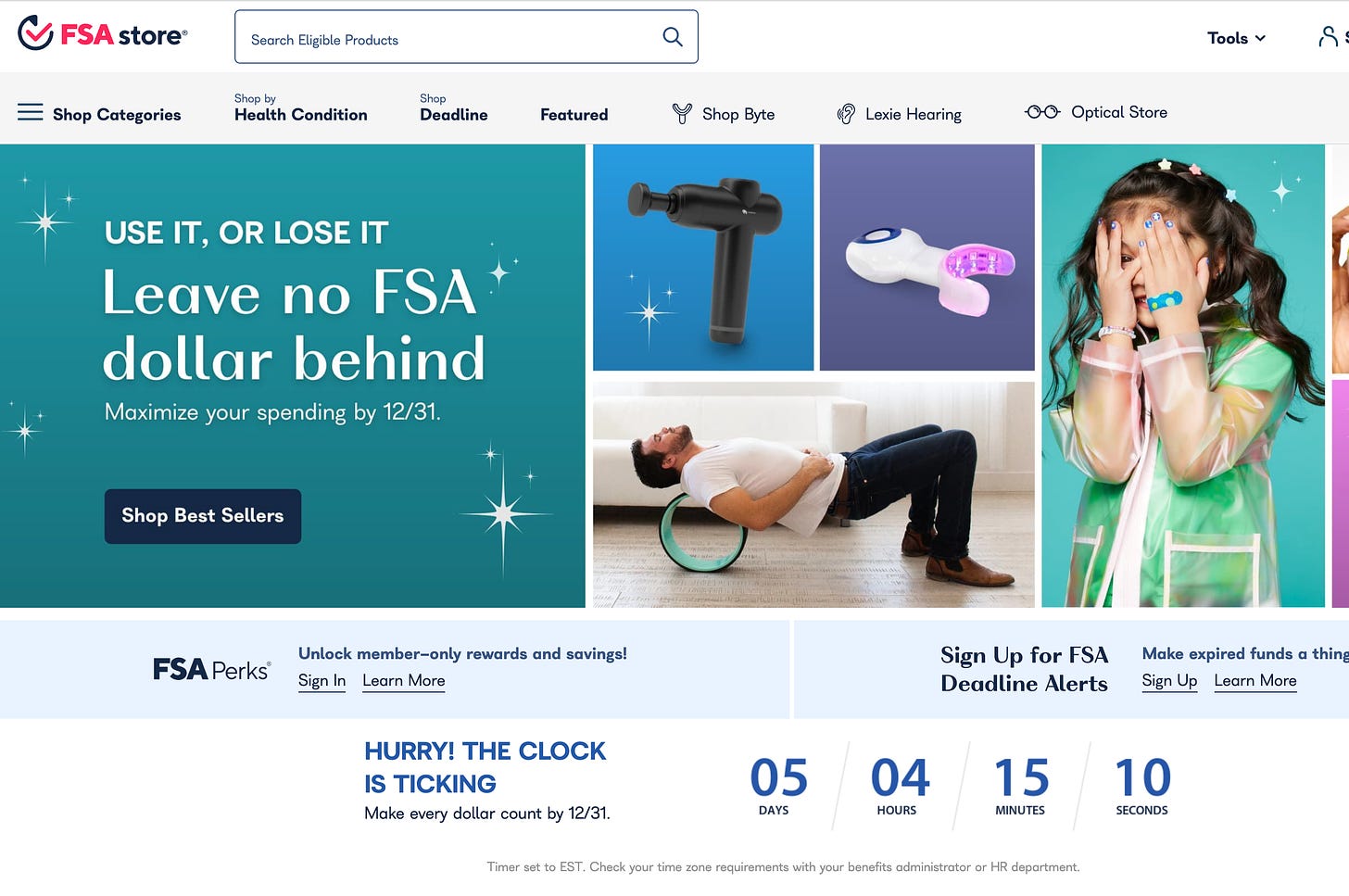

But with the new year deadline approaching, many people are trying to use up the money they diverted to their FSAs during 2022 by splurging on spare eyeglasses, electronic massagers, first aid kits and other vaguely medical knickknacks they don’t really need. There’s a whole mini-industry of online stores specializing in FSA-approved items.

The perversity of such last-minute ill-targeted health-care spending is only the tip of the iceberg: By one estimate, consumers lost $4.2 billion in unspent FSA funds in 2020.

We have struggled so much with our own family’s FSA that we decided to look under the hood. What we’ve concluded is that it’s time to reevaluate the value of FSAs.

Here is how they’re supposed to work, whether for health- or child-care expenditures. You predict your expenses for the coming year, and your employer lets you set aside some money for those expenses from every paycheck. This reduces your taxable income, and if you Google “FSA,” most hits will present it as a savvy way to save some money.

But if you don’t spend all of the money you set aside by the year-end deadline, you lose it — and that leftover money reverts to the employers. (They have a variety of options for what they do with it, including paying for the FSA’s administrative costs, reducing future employee FSA costs or, in some cases, keeping the money.)

As Vox Media’s Ian Millhiser put it:

But in practical terms, the real issue is that FSAs waste a lot of user time and money.

How much money? Definitive estimates are hard to come by. The government doesn’t track these expenditures at the individual level, and the private firms that administer the FSA don’t have to report data. For what it’s worth, one analysis by Money magazine estimated that almost half the 21.6 million Americans with FSAs forfeited money in 2020, with an average loss of $408.

The administrative burdens involved are also a time tax on users. Workers typically set up an account through their employer with a private FSA vendor who assesses whether their expenses qualify. Submitting an expense request often involves a lot of photocopying, scanning and uploading receipts. You have to know what is allowed and what is not, and which form to submit. If your insurance company is involved, you can’t claim reimbursement until it has paid its share. Claims can be rejected for seemingly mystifying reasons, with little avenue for redress. If your employer changes your FSA provider, you have to learn a new set of procedures. Few of us who are not professional health-service administrators have the skills, discipline, organization and time to do this effectively.

In public policy terms, the most obvious policy drawback to FSAs is that they are a regressive benefit. It’s largely salaried employees with higher incomes who benefit from them, and the value of the tax deduction increases as you enter a higher tax bracket. This reflects a general problem with policymaking — we rely too much on tax deductions rather than direct benefits. The use of such deductions has to be monitored — generally, in this case, by the private FSA vendors, who are the reliable winners in this whole process.

It’s all a lot more complicated than it has to be, and a lot less beneficial to the American families FSAs are supposed to help. Policymakers need to break the habit of favoring complexity over simplicity. Politically it might be easier to gain bipartisan support for tax deductions rather than direct spending, but such policy solutions systematically underestimate the hassles involved, and undervalue the time we spend clawing our money back from private financial firms.

Please share your FSA stories - positive or negative - in the comments

They benefit those who make more money. But I agree its a hassle. Using the debit card that may come with the FSA as a convenience actually means you lose the 5% rebate you could use with certain credit cards such as Target red card, or the Amazon for medical items. (and 1-2% for a regular rebate credit card) all to save in filling steps.

My FSA used a credit card, so no forms needed! I kept the fsa card on file at my pharmacy so the charges for prescriptions went right through the fsa account. Yes it is tricky to estimate how much you need each year; I generally underestimated and ran through my funds by November/December